new mexico gross receipts tax form

They offer faster service than transactions via mail or in person. Do I need a form.

Taxation and Revenue New Mexico.

. Granting a right to use a franchise in New Mexico. The folders on this page contain everything from returns and instructions to payment vouchers for both income tax programs and business tax programs. No forms are required.

After registering the business will be issued a Combined Reporting System CRS Number sometimes known as a New Mexico Tax Identification Number. Electronic transactions are safe and secure. It varies because the total rate combines rates imposed by the state counties and if applicable municipalities where the businesses are located.

New multi-year tax forms available. Ad Get A Jumpstart On Your Taxes. Sell property in New Mexico.

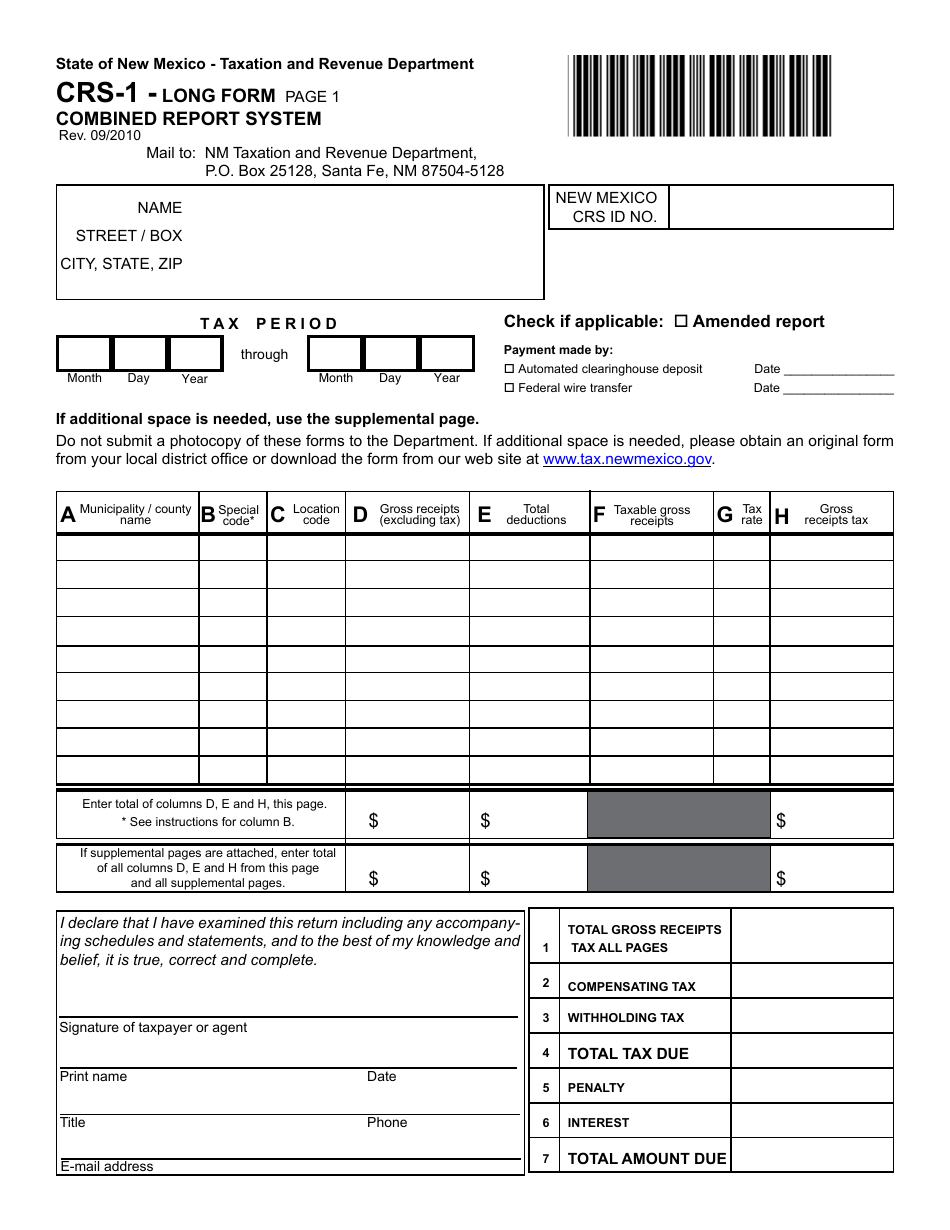

In order of appearance Announcements Due Dates Department Office Locations Gross Receipts Tax Rate Schedule Taxpayer Bill of Rights CRS-1 Form Instructions CRS-1 Report Forms CRS-1 Long Form Other Forms Information. Welcome to the Taxation and Revenue Departments Forms Publications page. How to Claim a Refund When You Are Also Required to E-File Your Return.

Ad Were here to help with all of your tax preparation needs. Performing services in New Mexico. The tax is imposed on the gross receipts of persons who.

Certain taxpayers are required to file the Form TRD-41413 electronically. Click HERE for the Lincoln County HBA Membership Application Form. Governmental Gross Receipts Tax Leased Vehicle Gross Receipts and Surcharge Tax Non-wage Withholding Tax Wage Withholding Tax.

The same sale in the city of Santa Fe would result in a gross receipts tax due of 945 112 x 84375. The gross receipts tax rate varies throughout the state from 5125 to 86875 depending on the location of the business. Import Your Tax Forms And File For Your Max Refund Today.

Gross Receipts Tax Return form USNMTRD41413 for Sales and Sellers Use Tax Compensating Tax Returns form USNMTRD41412 for Consumer Use Tax Avalara will not support these tax types. 0Rev 00202 New Mexico Taxation and Revenue Department 30900200 LEASED VEHICLE GROSS RECEIPTS TAX AND SURCHARGE RETURN WHO MUST FILE. TaxFormFinder provides printable PDF copies of 81 current New Mexico income tax forms.

Executive Officer Beverlee Antonio Phone. Taxation and Revenue New Mexico. Receipts from selling livestock and the receipts of growers producers and trappers from selling live poultry unprocessed agricultural products for example a bale of hay a head of lettuce or an unroasted sack of green chili hides or.

Total Gross Receipts Tax. 7875 on 112 sale price excise tax to come up with gross receipts tax due of 882. Vendors have the ability to pass the cost of the gross receipts tax to card holders.

Has helped thousands of clients with their tax issues for years. BEnter the total amount of gross re- ceipts tax from all Schedule A pages. Tangible personal property including electricity and manufactured.

You can locate tax rates Tax Authorizations Decisions and Orders and Statutes Regulations. The leased vehicle gross receipts tax and the leased vehicle surcharge apply only to short-term leases of vehicles when the following four conditions are met1 The lease is for a term of six months or less 2. Fast Easy Secure.

A gross receipts tax permit can be obtained by registering for a CRS Identification Number online or submitting the paper form ACD-31015. Enter the total amount of gross receipts excluding tax here. 19 rows New Mexico has a state income tax that ranges between 17 and 49 which is administered by the New Mexico Taxation and Revenue Department.

Select the GROSS RECEIPTS TAX OVERVIEW link and the FYI-105 PUBLICATION link for additional information provided by the New Mexico Taxation and. No Matter What Your Tax Situation Is TurboTax Has Your IRS Taxes Covered. Certain taxpayers are required to filethe Form CRS-1 electronically.

The following receipts are exempt from the NM gross receipts tax sales tax. Shop Save Today. The State of New Mexico does not directly impose State sales tax on consumers instead it assesses a gross receipts tax on vendors.

Our advice is that you e-file and e-pay. This document provides instructions for the New Mexico combined reporting system Form CRS-1 which includes gross receipts withholding and compensating tax. Ad Register and subscribe 30 day free trial to work on your state specific tax forms online.

GROSS RECEIPTS TAX RETURN GENERAL INFORMATION This document provides instructions for the New Mexico Form TRD-41413 Gross Receipts Tax Return. Selling research and development services performed outside New Mexico in which the product is initially used in New Mexico. In Las Cruces it would result in a gross receipts tax due of 931 112 x 83125.

New Mexico Taxation and Revenue Department GOVERNMENTAL GROSS RECEIPTS TAX RETURN This report can be filed online at httpstapstatenmus I declare that I have examined this return including any accompanying schedules and statements and to the best of my knowledge and belief it is true correct and complete. Monthly Local Government Distribution Reports RP-500. The gross receipts tax is a tax on persons engaged in business in New Mexico for the privilege of doing business in New Mexico.

Each Form TRD-41413 is due on or before the 25th of the month following the end of the tax period being reported. Information needed to register includes the. Ad Discover a Wide Selection of Tax Forms at Staples.

New Mexico Gross Receipts Tax July 2014 Are You Paying Too Much GRT on Real Estate Commissions. Each Form CRS-1 is due on or before the 25th of the month following the end of the tax period being reported. New Mexico Gross Receipts Tax.

New Mexico Taxpayer Access Point allows taxpayers to file their taxes make payments check refund statuses manage their tax accounts register new businesses and more. AEnter the total amount of gross receipts tax due here. 6 - form trd-41413 gross re- ceipts tax return and schedule a 1 - form 41413 gross receipts tax business-related tax credit sched- ule cr and supplemental schedule cr grt payment voucher instructions and 7-grt-pv acd-31015 - business tax registra- tion application and update form rpd-41071 - application for tax refund acd-31050 -.

Edit Fill eSign PDF Documents Online. If not you should be filing form TRD-41413 Gross Receipts Tax Return. Property Tax Division.

The current tax year is 2021 and most states will release updated tax forms between January and April of 2022. Fill Print Go. President Patrick Seaman Phone.

This is allowable even on CBA transactions. Staples Provides Custom Solutions to Help Organizations Achieve their Goals. Property includes real property.

Gross Receipts tax rates are subject to change twice a year. For Reporting Gross Receipts Withholding and Compensating Taxes Contents In This Kit. If Schedule A pages are attached enter total of columns D and I.

If you are requesting a refund of tax previously paid you must also submit Form RPD-41071 Application for Refund with all required attachments to the Department. The business pays the total gross receipts tax to the state which then.

A Guide To New Mexico S Tax System New Mexico Voices For Children

What You Should Know About Changes To Nm Tax Reporting Youtube

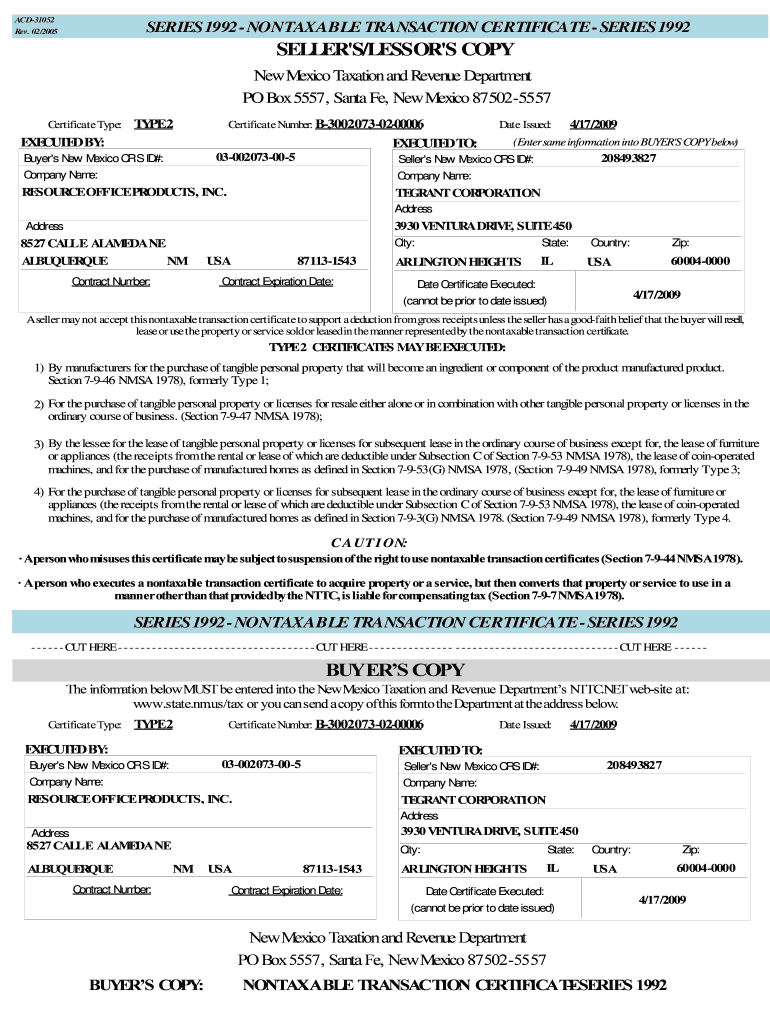

Nm Acd 31052 2005 2022 Fill Out Tax Template Online Us Legal Forms

New Mexico Sales Tax Small Business Guide Truic

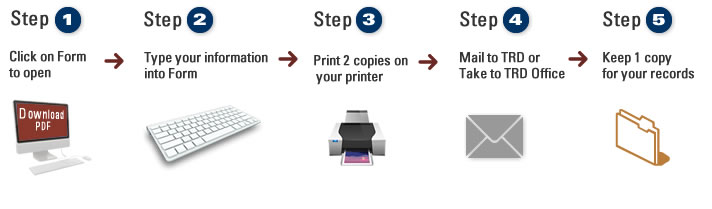

Fill Print Go Taxation And Revenue New Mexico

Energy Bill Scg Energy Bill Bills Energy

How To File A Gross Receipts Tax Grt Return In Taxpayer Access Point Tap Youtube

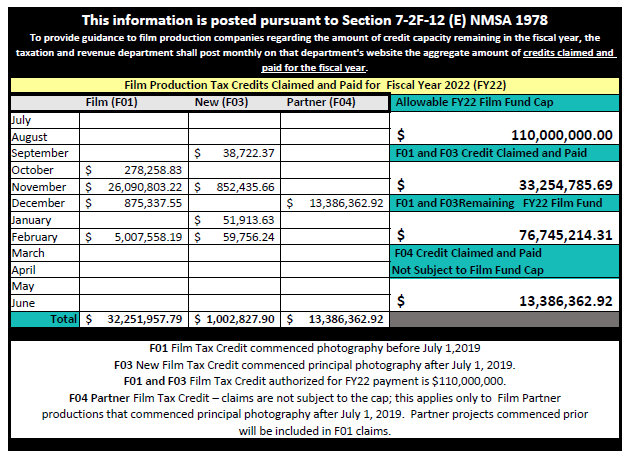

Film Production Tax Credit Tax Professionals

Gross Receipts Location Code And Tax Rate Map Governments

New Zealand 2020 21 Income Tax Year Taxing Wages 2021 Oecd Ilibrary

A Guide To New Mexico S Tax System Executive Summary New Mexico Voices For Children

64 Falcon 200 With Images Cars Cars Trucks Ford Falcon

Form Crs 1 Download Printable Pdf Or Fill Online Combined Report Long Form New Mexico Templateroller

New Mexico Gross Receipts Tax Nmgrt Law 4 Small Business P C L4sb

Menion Net Bonds Certificate Templates Corporate Bonds Gift Certificate Template

Reporting Locations And Claiming Deductions For Gross Receipts Tax Youtube

Gas Bill Columbus Gas Ohio Id Card Template Gas Bill Electricity Bill Payment